PHOTO

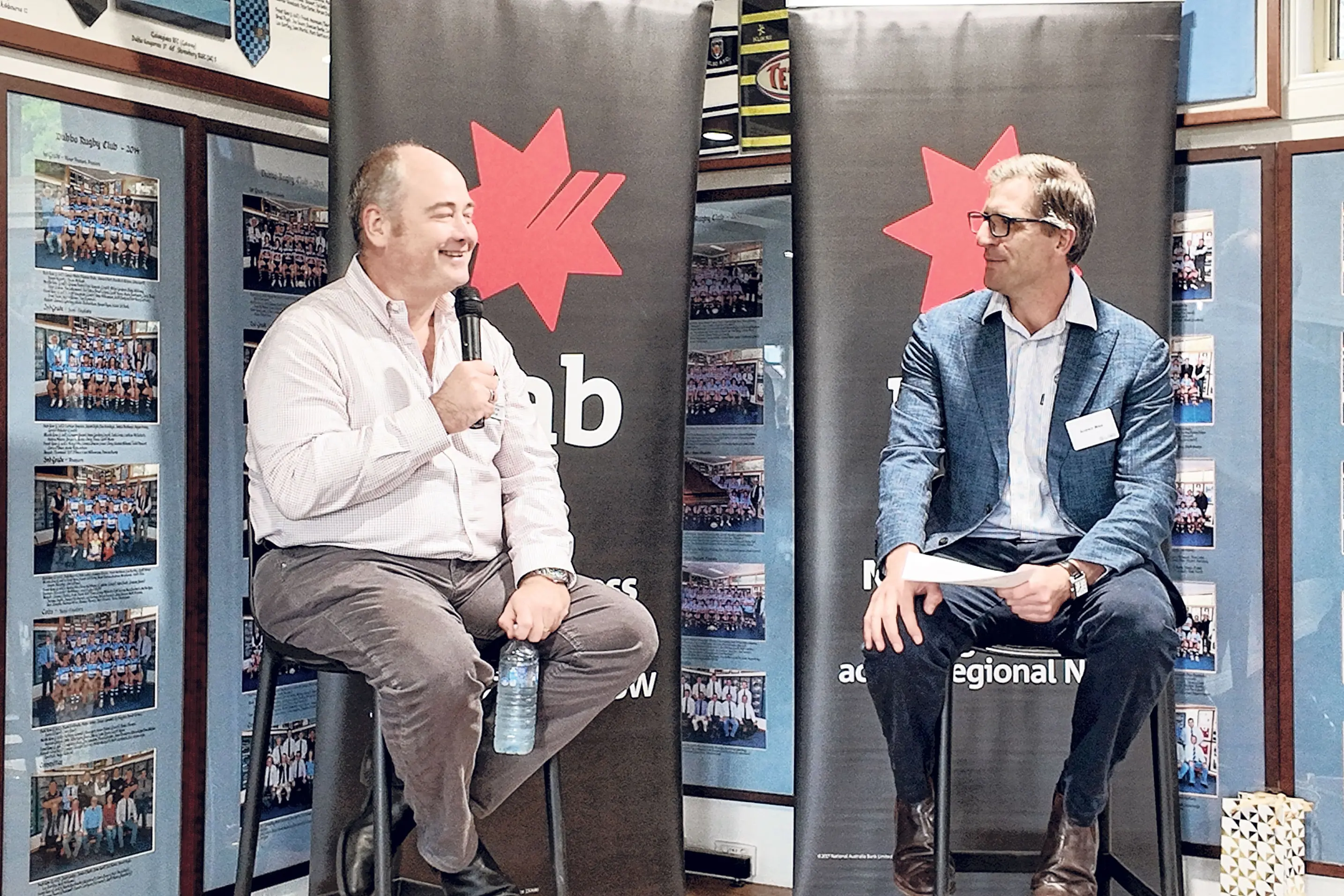

The Chief Executive Officer (CEO) of the National Australia Bank (NAB), Andrew Irvine, visited Dubbo late last month and was a special guest at an AgriFocus networking function on Wednesday, October 22, at the Dubbo Rugby Club.

Mr Irvine, who came to Australia to work for NAB at the beginning of the pandemic, spoke about his life and career which has seen him live, study and work in many parts of the world.

Born in Spain, the married father of three regards Hungarian as his first language, courtesy of his mother, and he has also lived in Sri Lanka, Romania, the United Arab Emirates, Turkey, the United Kingdom and Canada before coming to Australia.

Mr Irvine told those gathered that CEOs do three things in their roles: set the culture and behaviours within the business, pick the people that run the company, and allocate resources and make investment decisions. Sometimes the decisions made by CEOs may not be considered fair, he said.

He also said it was important in business to spend time with customers and staff as the best way to learn what is going on.

"I would never spend time with customers if I didn't allocate the time, because you get incredibly busy," he said, indicating he scheduled time in his diary a year ahead to spend time with the bank's customers and frontline teams.

"This [trip to Dubbo] was booked over a year ago," he added.

Mr Irvine imparted some practical career advice to those attending.

"You've got to do work that gives you pleasure ... or you're going to have a hard life. You've got to love it or do something else. I believe that passionately," he said.

"You've [also] got to work with people and for someone who's going to make you better," he advised.

"If you're not working with people that are smarter than you, that care about you, that are going to train you, coach you and improve you, you're in the wrong place. And if you're the smartest person in the room, you're in the wrong place," he said.

"And sometimes, being a bit courageous and taking a calculated risk, I think, is important. If you're always in your comfort zone, you're probably not learning."

Responding to a question on the proliferation of artificial intelligence (AI), Mr Irvine encouraged people to not be afraid to explore and play with AI.

"The adage I use is AI isn't going to take a job. People using AI are going to take the jobs of people not using AI, because your ability to compete will simply not be there," he said.

On the issue of cyber security, Mr Irvine spoke about a sophisticated $30million scam occurring in Singapore earlier this year despite many steps being taken to establish legitimacy. Various methods including voice-printing and physically replicating in an online meeting the CEO of the unnamed Singaporean company approving a $30 million payment were allegedly used to pull off the scam.

Mr Irvine said many existing security technologies were already compromised, providing challenges for businesses in this space.

On the question of the future of cash in an increasing environment of electronic payments, Mr Irvine said cash would always be around but will decrease as a method of payment.

"There's more cash in circulation now than there's ever been, but the proportion of cash that's used to buy stuff is the lowest it's ever been. People have cash but they're not using it to actually buy things," he concluded.